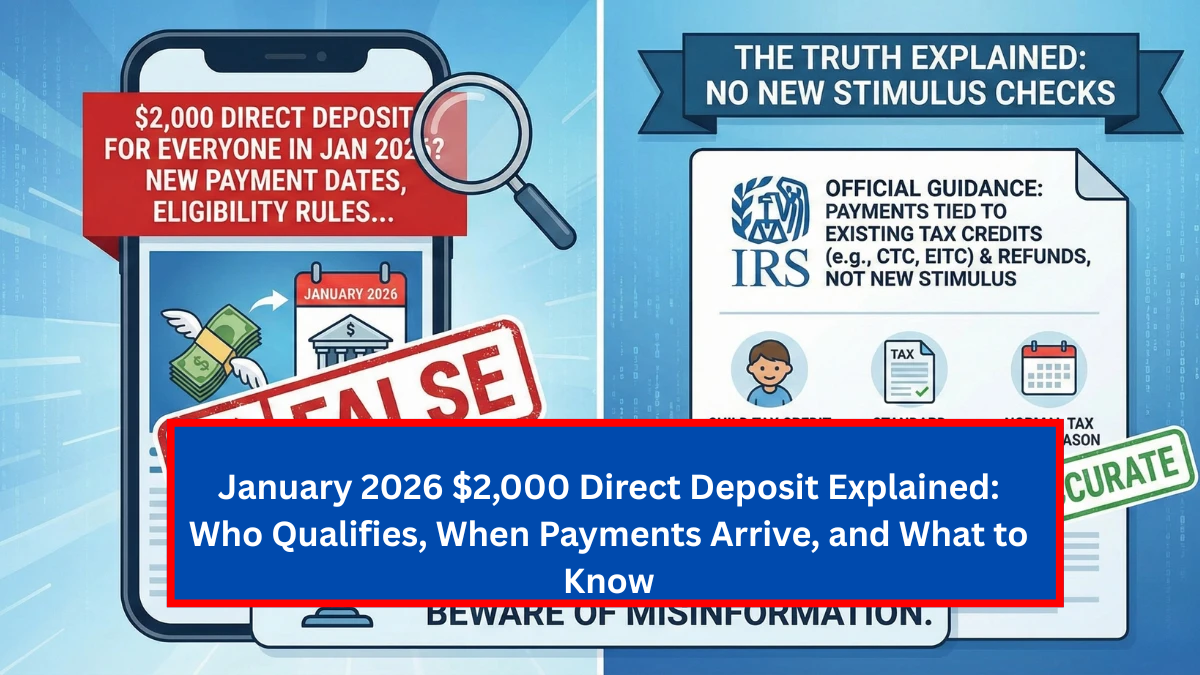

Claims of a $2,000 direct deposit for all Americans in January 2026 have circulated widely online, creating expectations of a guaranteed federal payment with fixed release dates. In reality, much of this confusion stems from misunderstandings between standard tax refunds, credit-based refund amounts, and unverified stimulus-style rumors. This article explains what is officially confirmed, why some refunds may total around $2,000, and how eligibility and payment timing are determined by the Internal Revenue Service.

Is There a $2,000 Direct Deposit for Everyone

No. There is no approved program that sends $2,000 to every individual in January 2026. The IRS has not announced any universal direct deposit, stimulus payment, or federal relief program at this amount.

Claim vs Reality

$2,000 payment for all Americans ❌ Not approved

New federal stimulus announced ❌ No

Tax refunds issued in January ✅ Yes

Refunds near $2,000 possible ✅ Yes

Automatic eligibility for everyone ❌ No

Why the $2,000 Amount Keeps Appearing in January 2026

The $2,000 figure appears frequently because many individual tax refunds naturally fall close to that amount. Refund totals depend on federal tax withholding, refundable credits, deductions, and filing status, especially during the early weeks of tax season.

Who May Actually Receive Around $2,000

Refund amounts are not universal and vary based on individual tax situations, including:

- Filing status

- Annual income and taxes withheld

- Refundable tax credits claimed

- Accuracy of return information

- IRS verification or review requirements

Two taxpayers filing on the same day can receive very different refund amounts.

January 2026 Payment Timing Explained

For taxpayers who file electronically and choose direct deposit, refunds typically arrive within 10 to 21 days after IRS acceptance, provided there are no processing issues. Additional bank processing may add one to three business days.

Why Some Refunds Are Delayed

Refunds close to $2,000 often involve refundable credits or tax reconciliations that may trigger IRS verification or manual review. These checks can delay payment without affecting eligibility or the final refund amount.

Is There an Application for a $2,000 Payment

No. There is no application process for a $2,000 payment. Receiving a refund only requires filing an accurate and valid tax return.

How to Confirm If You Will Receive a Deposit

Taxpayers should rely only on official sources by:

- Using IRS refund tracking tools

- Monitoring bank deposit notifications

- Reviewing IRS notices carefully

- Avoiding unverified social media claims

Key Points to Remember

- No $2,000 payment for everyone exists

- Refund amounts are calculated individually

- January deposits are tax refunds, not stimulus payments

- Eligibility varies by taxpayer

- Only IRS tools provide accurate payment status

Conclusion

The claim of a $2,000 direct deposit for everyone in January 2026 is misleading. While some taxpayers may receive refunds near that amount, no universal payment program has been approved. Any deposit depends entirely on individual tax filings, eligibility factors, and IRS processing timelines.

Disclaimer

This article is for informational purposes only and does not constitute tax or financial advice. Payment amounts, eligibility, and timelines depend on individual circumstances and official IRS determinations. Always rely on official IRS tools and notices for accurate information.