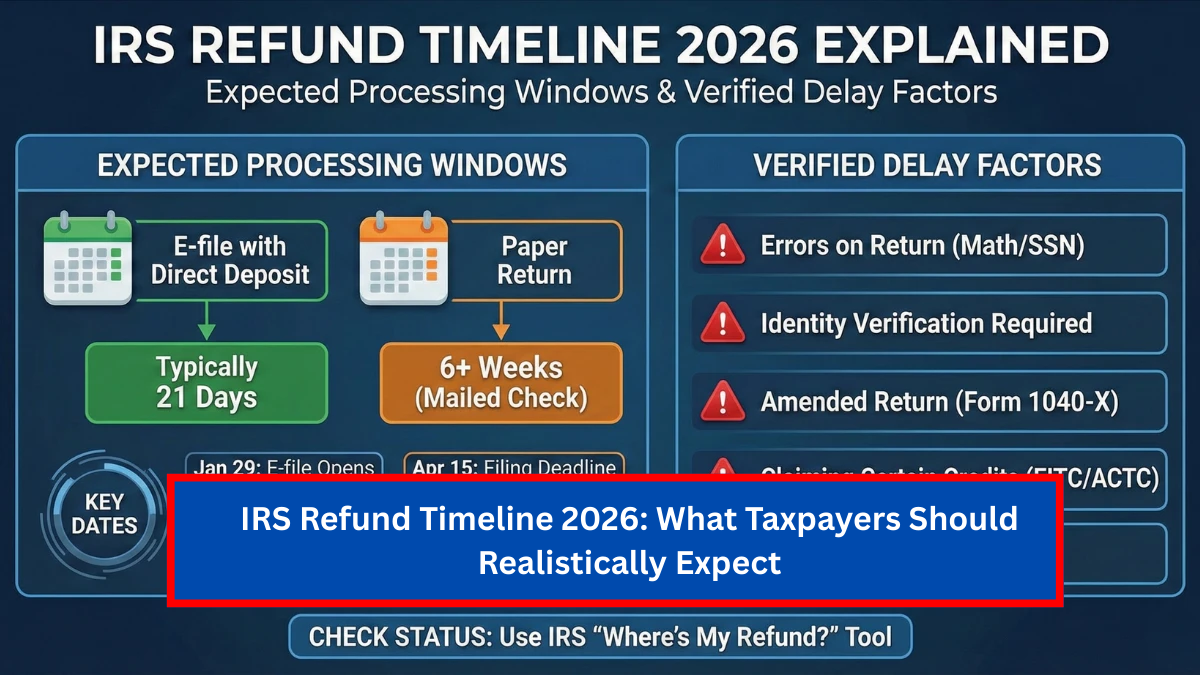

Interest in the IRS refund timeline for 2026 is growing as taxpayers prepare their returns and look for reliable guidance on when refunds may arrive. To avoid confusion caused by misleading claims, it is important to understand that refund timing depends on how a return is filed, its accuracy, and overall IRS processing capacity—not on fixed or guaranteed payout dates.

Is There an Official IRS Refund Schedule for 2026?

The Internal Revenue Service does not publish a fixed refund calendar with guaranteed payment dates. Refunds are issued on a rolling basis after a tax return is accepted and fully processed. Any claims promising an exact refund date for 2026 should be viewed cautiously unless they come directly from official IRS announcements.

Estimated IRS Refund Processing Windows (Based on Standard Practice)

| Filing Method | Typical Processing Time |

|---|---|

| E-file with direct deposit | Around 21 days after acceptance |

| E-file with paper check | Longer than direct deposit |

| Paper-filed return | Several weeks or longer |

| Amended return | Significantly longer processing time |

| Returns under review | Timeline varies |

How the IRS Processes Refunds

After a return is received, the IRS conducts multiple checks. These include verifying taxpayer information, matching income and withholding data with employer and financial institution records, and applying credits or corrections when necessary. Refunds are only released once these steps are completed, which is why processing times can differ even among returns filed on the same day.

Common Reasons IRS Refunds Are Delayed

Most refund delays are caused by routine verification or correction requirements rather than new tax rules or payment issues. Errors, missing details, identity verification, or additional review of credits can all extend processing timelines.

Where to Check Your Refund Status

Taxpayers can monitor their refund status using official IRS tools after their return has been accepted. These updates show the current stage of processing and should not be confused with approvals for new payments or benefits.

Key Facts to Remember

- The IRS does not guarantee refund dates

- E-filing with direct deposit is typically the fastest option

- Paper-filed and amended returns take longer to process

- Errors or reviews commonly cause delays

- Only official IRS tools provide accurate refund status

Conclusion

The IRS refund timeline for 2026 will follow established processing procedures rather than a fixed payment schedule. While many refunds are issued within a few weeks of acceptance, delays can occur for valid reasons. Taxpayers are best advised to rely on official IRS status updates and avoid claims that promise guaranteed refund dates.

Disclaimer

This article is for informational purposes only and does not constitute tax, legal, or financial advice. Refund timelines depend on individual filings, IRS procedures, and official government operations.