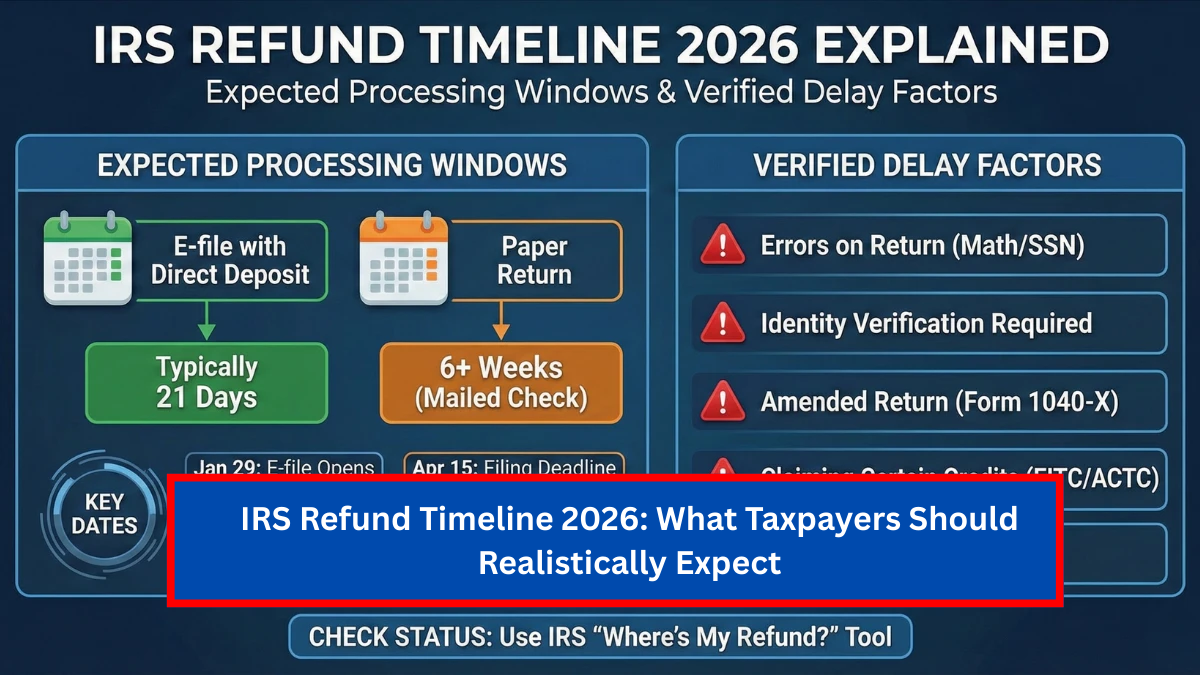

IRS Refund Timeline 2026: What Taxpayers Should Realistically Expect

Interest in the IRS refund timeline for 2026 is growing as taxpayers prepare their returns and look for reliable guidance on when refunds may arrive. To avoid confusion caused by misleading claims, it is important to understand that refund timing depends on how a return is filed, its accuracy, and overall IRS processing capacity—not on … Read more