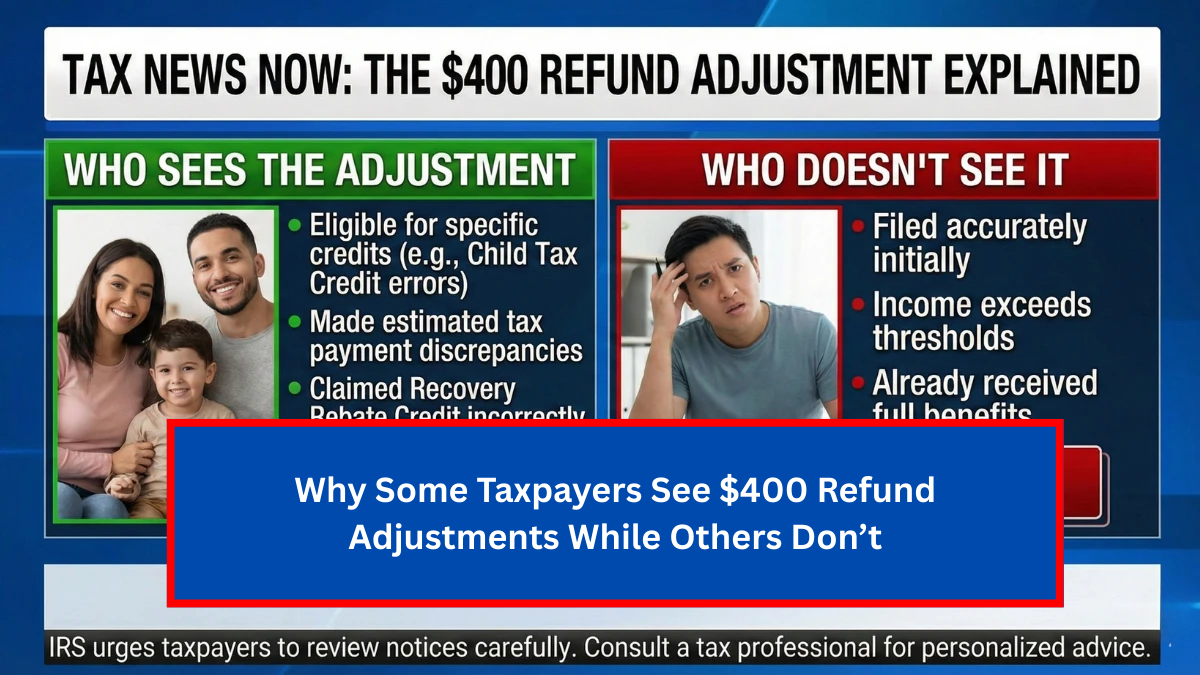

Why Some Taxpayers See $400 Refund Adjustments While Others Don’t

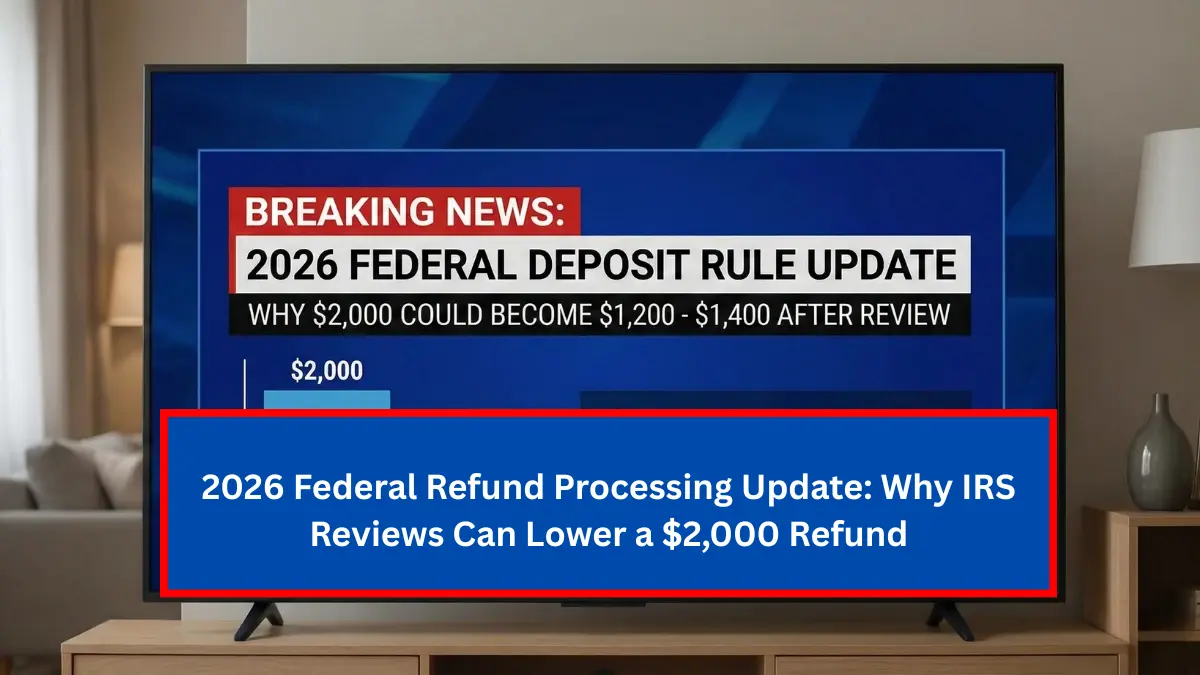

During recent tax seasons, many taxpayers have noticed IRS refund adjustments of around $400, while others with similar returns receive the exact amount they expected. This difference often causes confusion and concern. In most cases, these adjustments are routine and do not indicate penalties or audits. This article explains why $400 refund adjustments occur, why … Read more